Best Updated Complete Non VBV BIN Checker 2026

Today, we guide you through our Non VBV BIN Checker. Our team explains each step in plain language, sharing practical insights and best practices.

- What to expect: definitions, how-to walkthroughs, common pitfalls, and expert tips to build confidence.

- Outcome: By the end, you’ll have sharpened your carding skills and applied what you learnt responsibly and effectively.

Buyccfullz Team

At Buyccfullz.com, we are a team of experienced carders dedicated to offering reliable, tested carding guides. The majority of us began carding a decade ago and are still counting, and we have developed our abilities in a variety of carding techniques over the years. From beginners to seasoned pros, we’re here to help you master the art of carding.

Non VBV BINs Meaning

We begin with the fundamentals and clarify the core meaning of this topic. By knowing the Non VBV Bins meaning.

BINs

BINs are Bank Identification Numbers—the first 6–8 digits on a payment card. They identify the card’s issuing institution and attributes like:

- Card network (e.g., Visa, Mastercard), type (debit/credit/prepaid), and sometimes issuing country

- Routing details used by payment processors to send the transaction to the correct issuer

- Signals for fraud checks, currency/region handling, and card capabilities

In short, BINs help merchants and payment gateways recognize where a card comes from so transactions can be routed.

Non VBV / Non MSC

“Non VBV” or ”Non MSC” typically refers to cards or transactions that are not enrolled in, or do not trigger, 3-D Secure program called Verified by Visa (VBV) or Mastercard Secure Code (MSC). 3-D Secure adds an extra authentication step (such as a one-time code (OTP) or bank app confirmation).

Key points:

- VBV/MSC: 3-D Secure protocol for step-up authentication.

- Non VBV / Non MSC: A card or transaction path where this extra check isn’t required or doesn’t

BIN lookup Tool

A BIN checker is a lookup tool that identifies details about a payment card’s Bank Identification Number (the first 6–8 digits). By entering those digits, the tool returns metadata used in payments operations, such as:

- Issuer information: bank name, country, and sometimes contact details

- Card network and type: Visa/Mastercard/Amex; credit, debit, prepaid, or corporate

- Product and level: classic, platinum, business, etc.

- Additional attributes: card brand/sub-brand, currency, and sometimes whether 3‑D Secure is supported

Advantage:

- With a BIN lookup tool, it’s possible to see the country and sometimes contact details. For carding it’s important to match your VPN, RDP or proxy with this BIN location.

Disadvantages:

- Data freshness and accuracy can be unreliable, with significant gaps in coverage for new or less common BIN ranges. This means that a bin lookup tool is not accurate.

- It’s crucial to remember that BIN data is meta-level information. It doesn’t confirm the card balance.

Conclusion:

For carding, we often want to be sure that it concerns high-balance Non VBV BINs and that the data is accurate.

Non VBV BIN Checker

Now we know that a BIN lookup tool doesn’t work properly for carders, so we are looking for another Non VBV BIN checker. The best Non VBV Bin checker is yourself with the right high-quality shops that have a Non VBV filter. Shops like buyccfullz.com show Non VBV BINs only when Non VBV filter is enabled. For more, follow the instructions below:

Top CC Site: Buyccfullz.com

Buyccfullz eliminates the unpredictable nature of traditional shops. Every outcome is vetted for quality, and the platform runs the process for you—so you don’t waste time or make costly mistakes.

While Genie is $260 upfront, it pays for itself by replacing trial‑and‑error with predictable, repeatable results. Check below to learn more about Ai Carding:

Non VBV Fullz CC Packs on Carding: Better Results (CC Manager Tutorial)

How to import CCs into Carding Genie AI (CC Manager Tutorial)

Ultimate Carding Genie CC Manager Guide 2026

Ai Verification Bypass Tool (Identity + AVS) – Carding

High Balance BINs

Carders look almost always for high balance BINs on these CC sites. As you can see below the card limits vary:

Balance Checker

A Balance Checker helps prevent avoidable declines. Insufficient funds are a common signal that can activate automated blocks or step-up verification. Pre‑verifying balance—and knowing the safe order ceiling—improves approval odds, shortens time to completion, and reduces rework.

Update for 2026: You’ll need to use Non VBV BINs to check your available balance.

- Since April 2026, many VBV cards using a one-time password (OTP) to protect cardholders. This added step helps confirm identity during balance or transaction checks.

- Only Non-VBV BINs can pass through balance checkers without triggering OTP requests.

- For smoother experiences, ensure using Non VBV BINs instead of VBV.

Bin Location

We said earlier it’s important to match your VPN, RDP or Proxy with the location of the BIN:

- Payment routing and risk checks (e.g., flagging mismatched country/IP, tailoring 3‑D Secure rules)

If your location doesn’t match the bin’s position, there’s a very high chance your card will be blocked. This is because payments and verification checks are country/IP-based.

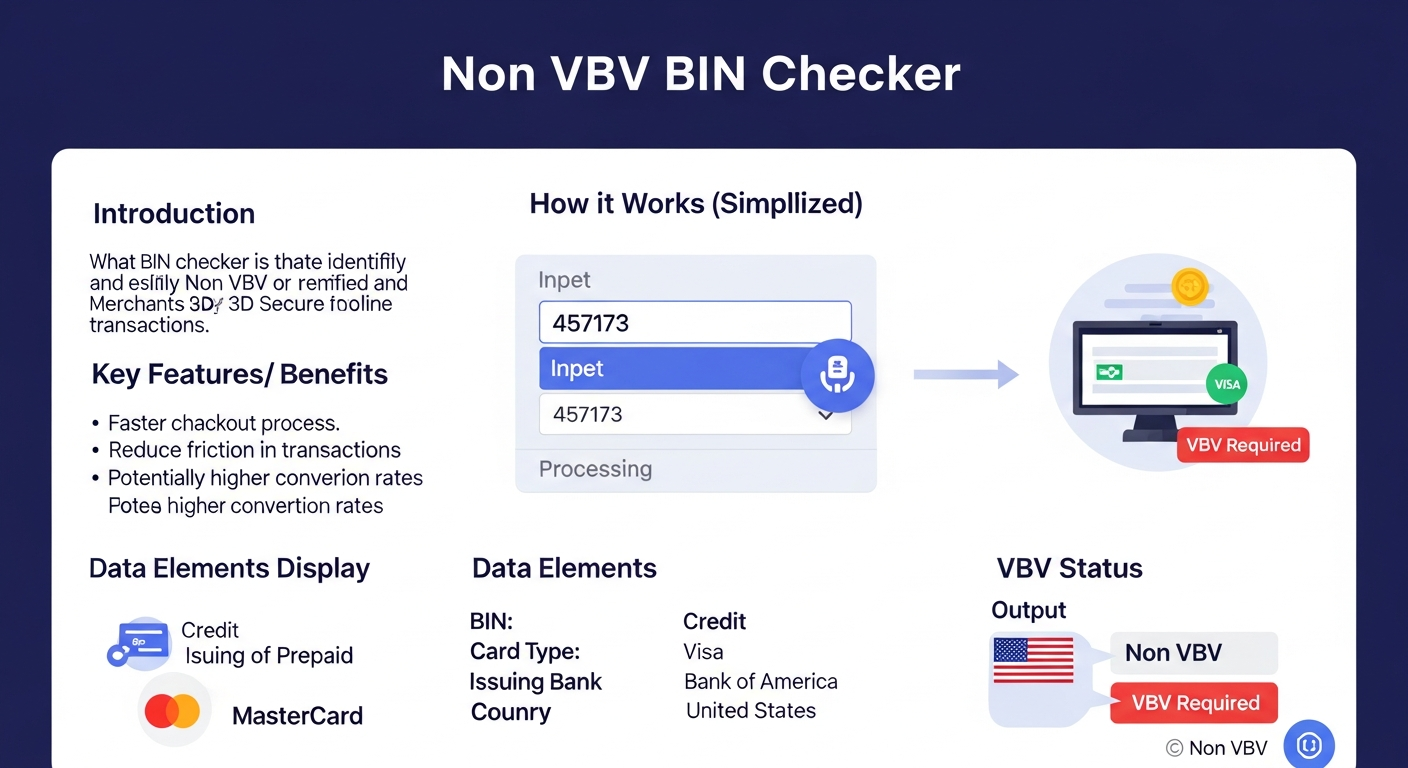

Infographic: Non VBV BIN Checker

Non VBV BINs USA

The USA Non-VBV BINs list is a valuable resource for carders. It provides a list of Non VBV BINs from major American banks, allowing users to perform high-value transactions without the risk of being flagged for suspicious activity. This updated and effective tool can help maximize profits while minimizing risks. (source: Latest Usa Non VBV Bins List 2026 )

Crypto Non VBV BINs

- Fraud screening varies by issuer and auth systems.

- In high‑volume crypto markets (e.g., U.S.), models often favor lower friction, reducing sensitivity to some risks.

- Carders take advantage of this, resulting in a high carding success rate.

Check below to view:

Best Non VBV BINs Crypto List 2026

Cardable Sites for Non VBV BINs

- Sites with VBV or MSC: At checkout, an extra identity step—like a password, bank app confirmation, or OTP—verifies the cardholder.

- Sites with Non VBV or Non MSC: Purchases may proceed without that added check, providing less certainty the payer is the rightful cardholder. Without step-up authentication, the carding success rate will increase.

FAQ: Non VBV BIN Checker

Informed by years of carding industry expertise, these are the questions we hear most often about the Non VBV BIN Checker!

What is a BIN?

BIN stands for Bank Identification Number (also called Issuer Identification Number, IIN). It’s the first 6–8 digits of a payment card number and identifies the issuing institution and key card attributes.

Non VBV BIN Checker 2026 – Greatest Guide

Who uses BINs?

Anyone involved in issuing, accepting, routing, or risk-managing card payments uses BIN data. Also, carders.

What is VBV and Non VBV?

- VBV: Verified by Visa (3D Secure)—extra cardholder authentication for online payments.

- Non‑VBV: Transactions where 3‑D Secure isn’t enforced.

Non VBV BIN Checker 2026 – Greatest Guide

What does Non VBV stand for?

“Non VBV” stands for “Non-Verified by Visa”.

What does Non VBV mean?

Online card transactions where Visa’s 3‑D Secure authentication isn’t required or enforced.

What does Non VBV BINs mean?

“Non VBV BINs” refers to card BIN ranges where Verified by Visa (3‑D Secure) isn’t enforced on certain transactions. In practice, it means cards from those BINs are more likely to complete online purchases without a 3DS challenge.

Non VBV BIN Checker 2026 – Greatest Guide

Where to find a BIN number?

You’ll find the BIN (Issuer Identification Number) in the first 6–8 digits of a payment card number.

What is a BIN checker tool?

A BIN checker tool is a lookup service that identifies details about a payment card from its first 6–8 digits (the BIN/IIN).

When Non VBV BINs are used?

Non‑VBV BINs gets used for carding where Visa’s 3‑D Secure (VBV) isn’t required, so checkout may skip the extra authentication step. You’ll see it, for example:

This occurs when merchants or publishers offer 3DS exemptions in regions with a high volume of transactions.

Why do I need to match BIN location?

If your IP location doesn’t match the location of the BIN, there’s a strong chance the card will be blocked. Most Bins and their verification checks use country- and IP-based restrictions.

Non VBV BIN Checker 2026 – Greatest Guide